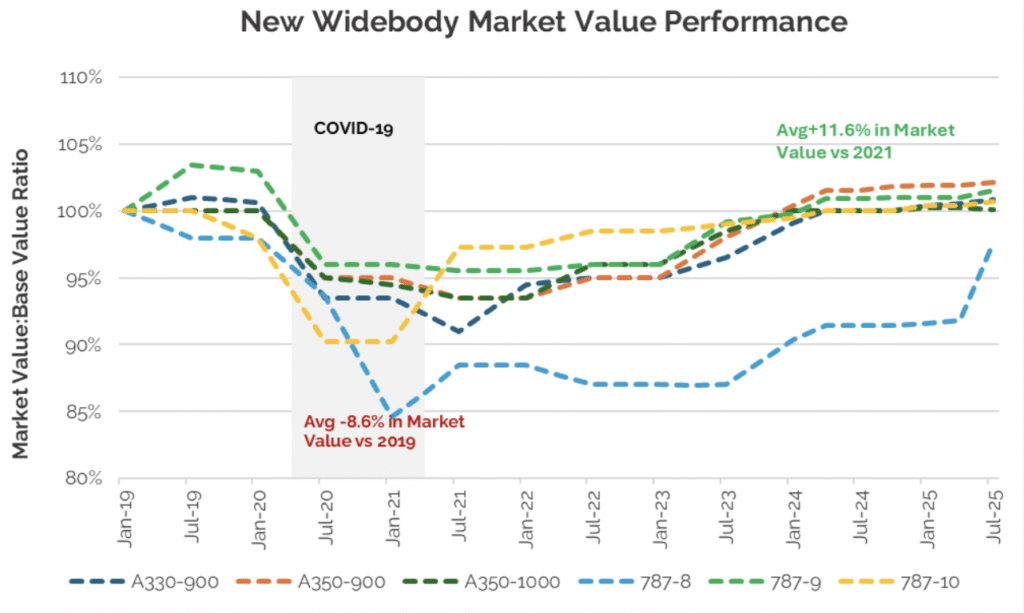

IBA, the aviation market intelligence and advisory firm, has reported that market values for new-generation wide-body aircraft have increased by an average of 11.6% since 2021. This reflects a sustained recovery in long-haul demand, ongoing fleet renewal and strong aircraft trading activity.

According to IBA Insight, values had fallen sharply during the pandemic, dropping by 8.6% compared with 2019. Since then, the market has steadily rebounded, with market-value to base-value ratios now at or above 100% for most wide-body types, including the Airbus A350-900, A350-1000 and Boeing 787-9. This growth is driven by heightened demand and continued supply constraints.

Hashen Hewawasam, the head of Commercial Aircraft Valuation at IBA, noted that the value recovery accelerated from early 2023 as international travel and premium leisure traffic returned. Long-haul capacity expansion, combined with production constraints at original equipment manufacturers and delivery schedules stretching into the 2030s, have created a seller’s market for these aircraft.

The Boeing 787-9 remains the most sought-after model, with market values now exceeding base value across all ages. The 787-10 has also recovered to base value levels, with the strongest performance seen in new production units. Notably, the 787-8 has experienced the fastest market value gains despite limited new deliveries, although values remain slightly below base.

The A350-1000 has benefited from delays to the Boeing 777X programme, generating significant orders and supporting value growth alongside the A350-900. The A330-900 is also gaining traction in the secondary market as an attractive A330ceo replacement.

The sale-and-leaseback (SLB) market has supported further value growth, with increased activity from airlines seeking capital and new lessor entrants offering aggressive pricing and lease rate factors.

IBA expects values for new generation wide-body types to continue rising, supported by inflation, OEM price escalation and the recovery of long-haul travel. Although growth is expected to lag behind narrow-body aircraft due to lower production and trading volumes, the outlook for wide-body values remains robust.