Lufthansa Technik has reported lower earnings for the third quarter of 2025, despite higher revenue. The company remains focused on long-term growth but continues to face pressure from tariffs and exchange rates.

Revenue rose by around €600 million to €5.9 billion in the first nine months, an 11.9% increase compared with the previous year. However, adjusted EBIT dropped to €440 million, down by €26 million or 5.6%. The profit margin fell to 7.4%, from 8.8% last year.

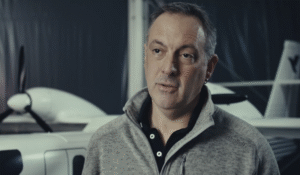

Chief Financial Officer Dr Christian Leifeld said the environment had become much tougher after a series of record results. “We have had to make painful cuts in earnings and margins,” he admitted. Yet he confirmed that the company would maintain its investment plans, stressing the need for strict cost control in every area.

Lufthansa Technik plans to invest billions in the coming years to secure future growth. In Portugal, it is spending 300 million euros on a new plant to repair aircraft components and engines. A second training centre near Porto has already opened.

In Canada, the company is building a maintenance site in Calgary for CFM LEAP-1B engines. Training for new staff has already started. In the United States, expansion continues at the Tulsa, Oklahoma, site, while the Hamburg headquarters is undergoing major modernisation with a three-digit-million-euro investment.

To offset tariff effects, Lufthansa Technik has redirected material flows and shifted repair work to other locations. Dr Leifeld said he was relieved that trade tensions between the EU and the US had not worsened. However, he warned that the current tariff regime “makes everything more expensive”.

He remains confident about revenue growth but admitted that matching last year’s EBIT will be a major challenge. (€1.00 = US$1.16 at time of publication).