Air cargo tonnages and rates from key Middle East and Asian origin markets remain highly elevated, especially to Europe, as strong demand and disruptions to ocean freight services meet limited capacity on key lanes, pushing up rates dramatically on several major intercontinental routes.

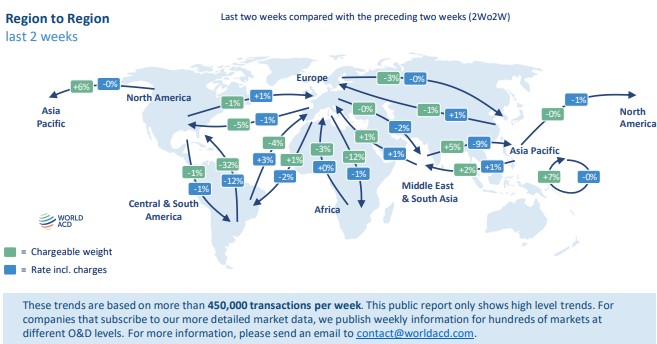

According to the latest weekly figures and analysis from WorldACD Market Data, worldwide tonnages have rebounded by a further 2% in week 20 following a similar increase the previous week, after dropping by around 8% at the start of May around the Labour Day holidays.

Meanwhile, average global rates remain more or less stable, rising just two cents to US$2.48 per kilo in week 20 (13 to 19 May) – which is up, year-on-year (YoY), by around 2% and significantly above pre-COVID levels (40% compared to May 2019). Tonnages, YoY, are up by 9% globally, although that figure is inflated by strong demand from Asia Pacific (15%) and Middle East & South Asia (16%) origins.

On a week-on-week (WoW), and two-week-on-two-week (2Wo2W) basis, average global and regional rates are relatively stable. But compared with last year, average rates from Middle East & South Asia (MESA) are highly elevated (45%). And to destinations in Europe, average rates from MESA origins remain more than double (119%) their level this time last year, as they have for the last seven weeks, based on the more than 450,000 weekly transactions covered by WorldACD’s data.

New analysis this week by WorldACD indicates that tonnages from MESA to Europe in the last two weeks are up, YoY, by 31%, with Dubai the top of the list in terms of origin growth points (148%). Those Dubai tonnages to Europe continue to be inflated by strong sea-air cargo due to the disruptions to container shipping in the Red Sea. But tonnages from Sri Lanka (57%) and Bangladesh (28%) are also significantly up, YoY, for the last two weeks combined.

The impact on pricing is even more dramatic, especially from key South Asia origin markets. Average rates from Bangladesh to Europe in week 20 stand at US$4.66 per kilo, almost three times their level this time last year (186%). Although tonnages from Bangladesh to Europe have eased slightly from their peak in week 14, those Bangladesh to Europe prices in week 20 are the second-highest this year. From India to Europe, rates have eased slightly in the last two weeks, but at US$3.72 per kilo they are still up 163% compared with the equivalent week last year.

As already highlighted, tonnages from Asia Pacific origins are up, YoY, by 15% as a whole, with rates up by 10%. Looking at Asia Pacific to Europe there are some considerable variations between the various main origin markets. For example, tonnages from China and Hong Kong to Europe have been up, YoY, by between 23% and 47% from weeks 14 to 18. That has eased somewhat in the last two weeks from China to Europe, where tonnages are up by just 19% and 10% in weeks 19 and 20, respectively, although Hong Kong to Europe tonnages remained up by 31%, YoY, in weeks 19 and 20.

On the pricing side, average rates from mainland China to Europe in the last four weeks have been up, YoY, by between 22% and 31, although from Hong Kong to Europe, the rates increases have been more modest, ranging from 3% to 23% in recent weeks. But from Vietnam to Europe, the market has seen some extremely high price levels for this time of year, with average rates of more than US$4 per kilo for the last four weeks and for most of the last eight weeks, which means prices are around double their rate this time last year (120% in weeks 19 and 20).

New analysis this week by WorldACD reveals that, of the world’s Top 20 air cargo origin markets, by total tonnages, Vietnam (13%) also recorded the second biggest 2Wo2W tonnage increase (in percentage terms) in weeks 19 and 20, combined, compared with weeks 17 and 18, second only to Italy (16%). Colombia recorded the biggest 2Wo2W decrease (42%), as a result of its big flower export volumes returning to normal levels following the surge ahead of Mother’s Day on 12 May. Similarly, the USA Atlantic South market saw the biggest 2Wo2W decrease of any Top 20 destination market, also linked to Mother’s Day flower shipment volumes returning to normal levels.

Japan (16%) saw the biggest 2Wo2W increase in tonnages of any Top 20 destination market, as its trade volumes returned to normal levels following the nation’s Golden Week holiday from 29 April to 5 May. For the similar reasons, it also recorded the (equal) second biggest 2Wo2W (in percentage terms) tonnage increase (13%) among the world’s Top 20 air cargo origin markets, although in absolute tonnage terms the increase was higher than that for both Italy and Vietnam.