IBA, the aviation market intelligence and advisory company, reports that airline capacity to North America (scheduled seats) for Thanksgiving 2025 is up 2.0% year on year, led by a 2.8% increase from full-service carriers. However, despite this uplift, airline profitability continues to decline, with operating margins tightening across both full-service and low-cost segments.

Data from the aviation intelligence platform IBA Insight shows that scheduled seats within North America, including US domestic services, account for 89% of total capacity, with flights from Europe and other regions providing the remainder. Low-cost carriers have posted only 0.5% capacity growth, and the Big Four US airlines continue to dominate the market, collectively supplying 66% of scheduled seats.

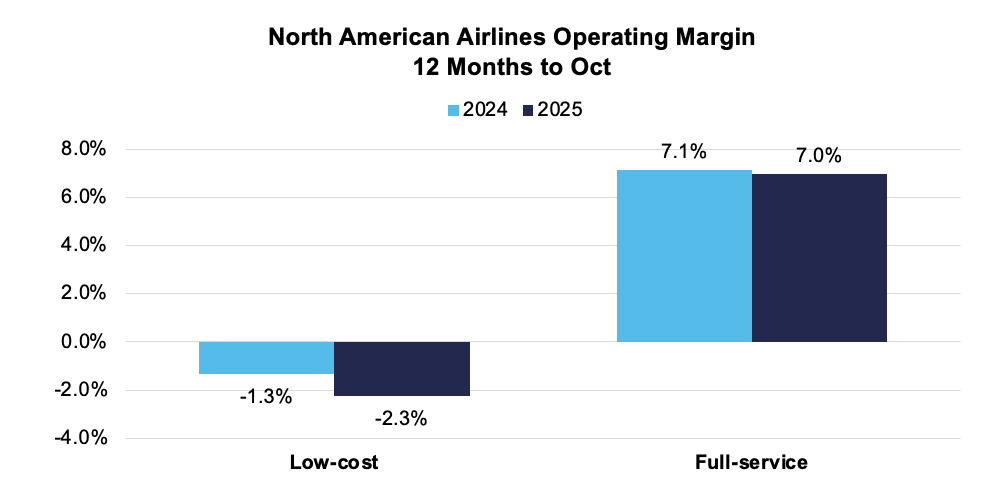

Despite this capacity rise, data from IBA Insight indicates that profitability has weakened. Low-cost carriers recorded a rolling twelve-month operating margin that had declined to –2.3% by the end of October 2025, down from –1.3% a year earlier, while full-service airlines slipped to 7.0% from 7.1% over the same period. The figures reflect ongoing cost pressures and softer revenues heading into the holiday period.

Recent third-quarter results further highlight divergent pressures across business models. Full-service airlines saw unit revenues soften by 0.4% in the twelve months to the end of October 2025, while low-cost carriers face rising unit costs, up 0.3%, driven partly by higher staffing and maintenance expenses. Performance among individual airlines varied, with Southwest Airlines delivering a modest 0.5% operating margin in Q3, whereas Spirit Airlines reported an improved but still negative –14.1% margin as it continues the structural changes initiated during its second Chapter 11 process.

The airline capacity growth follows disruptions linked to the recent US government shutdown, which temporarily affected air traffic control staffing and forced airlines to trim schedules at several major airports. With restrictions now lifted and the FAA confirming a return to regular operations, carriers enter the Thanksgiving travel window with improved operational stability, though financial headwinds remain.

Dan Taylor, Head of Consulting at IBA, said: “While travellers prepare to tuck into their Thanksgiving feasts, airlines may find there is a little less on their own profit plates this year, with rising costs and softer revenues giving the industry more to chew on over the months ahead.”