Thursday September 19, 2024

Airbus is responding to the forecasted demand for an additional 2.3 million trained workers in the airline services sector over the next 20 years by constructing a new aviation training campus. According to the latest Airbus Global Services forecast, this expa...

Read More »Thursday September 19, 2024

The Registry of Aruba has type validated Gulfstream's flagship G700 aircraft, following its European Union Aviation Safety Agency (EASA) approval in May. This recognition from the Department of Civil Aviation of Aruba (DCA) further cements the G700 as a premie...

Read More »Thursday September 19, 2024

Aviation Capital Group LLC (ACG), a global full-service aircraft asset manager, has announced the delivery of an Airbus A321neo aircraft to Condor Flugdienst. This aircraft, powered by the highly efficient Pratt & Whitney GTF engines, is the fourth of four...

Read More »Thursday September 19, 2024

Collins Aerospace has received the first-ever FAA Technical Standard Order (TSO) approval for a fully enabled multi-core processor. The Collins Multifunction Display, powered by Mosarc™, will enhance an aircraft's flight deck with 75% more capability compare...

Read More »Thursday September 19, 2024

TUI Airline has selected AVIATAR's Technical Logbook, Lufthansa Technik's cutting-edge digital platform, for its entire fleet of approximately 130 aircraft. TUI's five airline operations in the United Kingdom, Nordics, Belgium, the Netherlands and Germany are ...

Read More »Thursday September 19, 2024

Etihad Cargo, the logistics arm of Etihad Airways, and SF Airlines, a subsidiary of SF Holding, have revealed plans for a landmark joint venture, marking a historic milestone in the 40-year diplomatic relationship between the United Arab Emirates (UAE) and Chi...

Read More »Wednesday September 18, 2024

The U.S. Department of Transportation has granted approval for Alaska Airlines to proceed with its US$1.9 billion acquisition of Hawaiian Airlines, setting the stage for the first major U.S. airline merger in nearly ten years. However, the approval comes with ...

Read More »Wednesday September 18, 2024

Asia Digital Engineering (ADE), the maintenance, repair and overhaul (MRO) subsidiary of Capital A, and PT Garuda Maintenance Facility Aero Asia Tbk (GMF), an Indonesian MRO provider, have announced their strategic joint investment. This partnership represents...

Read More »Wednesday September 18, 2024

Eve Air Mobility (Eve) has appointed Megha Bhatia as its new Chief Commercial Officer (CCO) based in Melbourne. She will lead Eve's global sales, market intelligence, and government relations divisions. She joins Eve from Jet Support Services, Inc. (JSSI), whe...

Read More »Wednesday September 18, 2024

Satair, an Airbus Services company and a front-runner in the commercial aerospace aftermarket, has announced the opening of its new Logistics & Service Centre in Hamburg, Germany. Situated in the Wilhelmsburg area, the 56,500 m² facility is the largest wa...

Read More »Wednesday September 18, 2024

The Indonesian Air Force has ordered four Airbus H145 helicopters as part of its training modernisation programme. The order was announced at this week's Bali International Airshow. Under the agreement between the Indonesian Air Force and PT Dirgantara Indones...

Read More »Wednesday September 18, 2024

Falko Regional Aircraft Limited (Falko) has completed the delivery of four Embraer E175 aircraft on lease to Airlink, South Africa's leading independent regional carrier. The aircraft were delivered on behalf of Falko's managed fund, Falko Regional Aircraft Op...

Read More »Wednesday September 18, 2024

ExecuJet MRO Services Middle East has commenced heavy maintenance checks on South African-registered Embraer Legacy aircraft after receiving regulatory approval. The South African Civil Aviation Authority (SACAA) has officially authorised ExecuJet MRO Services...

Read More »Tuesday September 17, 2024

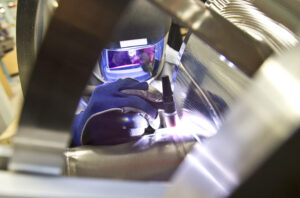

GKN Aerospace has strengthened its leadership in the aero-engine sector by announcing plans to expand the capacity and efficiency of its advanced manufacturing facility in Trollhättan, Sweden. The new production area, set to be fully operational by 2026, will...

Read More »Tuesday September 17, 2024

Textron Aviation has received approval from the Federal Aviation Administration (FAA) for its new safety management system (SMS) implementation plan, which supports the design and manufacturing of its Cessna and Beechcraft aircraft. This new approval complemen...

Read More »Tuesday September 17, 2024

Collins Aerospace, Pratt & Whitney and Delft University of Technology (TU Delft) have signed a master research agreement (MRA) to collaborate on sustainable aviation research. The partnership will explore advanced materials, hydrogen propulsion, advanced m...

Read More »Tuesday September 17, 2024

Kellstrom Aerospace has announced the relocation of its Asia office to Aerospace Park, Singapore. This strategic move highlights Kellstrom Aerospace Group's commitment to expanding in Asia, which includes Kellstrom Aerospace, Vortex Aviation and The Aircraft G...

Read More »Tuesday September 17, 2024

Scandinavian Airlines (SAS) and Braathens Regional Airways AB (BRA) have announced a long-term wet lease partnership aimed at ensuring reliable and efficient domestic air connectivity within Sweden. Under the agreement, BRA will operate several aircraft on beh...

Read More »Tuesday September 17, 2024

Boeing's 2024 Commercial Market Outlook (CMO) predicts that Africa's commercial airplane fleet will more than double by 2043, driven by a growing, youthful population seeking increased travel opportunities. The region is expected to see deliveries of over 800 ...

Read More »Tuesday September 17, 2024

First Aviation Services Inc., a provider of aircraft parts manufacturing, aircraft component maintenance and related engineering services, has announced its acquisition of Saint Technologies Inc., based in Shannon, Illinois. Founded in 1999, Saint Technologies...

Read More »